BTC Price Prediction: Can Bitcoin Hit $250K in 2025?

#BTC

- Technical Strength: Price sustains above key MA with MACD reversal pattern

- Institutional Catalysts: Corporate treasuries and Nasdaq listings amplify demand

- Risk/Reward: 2:1 upside to $132K vs current support at $112K

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge Above Key Moving Averages

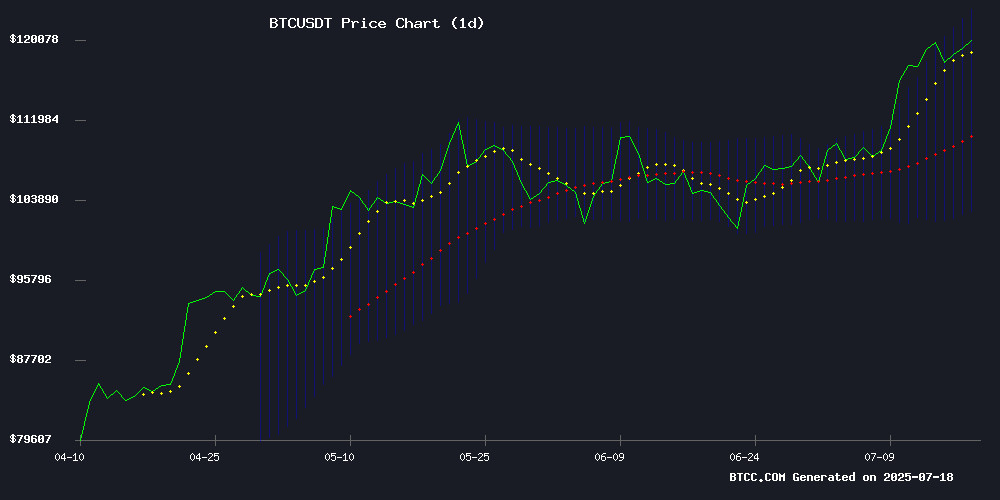

Bitcoin (BTC) is currently trading at, firmly above its 20-day moving average (MA) of, indicating a bullish trend. The MACD histogram shows a narrowing bearish momentum (-1,347.58), suggesting potential upward reversal. Bollinger Bands reveal price hugging the upper band (), signaling strong buying pressure.says BTCC analyst Olivia.

Market Sentiment: Institutional Adoption Fuels Bitcoin's $250K Narrative

Headlines highlight Bitcoin'samid whale accumulation slowdown and corporate adoption (MicroStrategy +3,558%, Riot Platforms' expansion). French nuclear mining proposals and Nasdaq-listed Bitcoin Standard SPAC merger underscore institutional interest.notes Olivia, while cautioning about Silk Road-related volatility risks.

Factors Influencing BTC’s Price

Bitcoin Breaks $121,000 Barrier, Eyes $132,000 Rally Ahead

Bitcoin has surged past the $121,000 mark, signaling potential for a rally toward $132,000. The cryptocurrency rebounded from a low of $115,730, climbing above $119,500 and the 50% Fibonacci retracement level. Analyst Ali Martinez predicts that a daily close above $121,000 could ignite a sharp upward movement.

Key resistance levels are identified at $120,200 and $121,400, with a breakout potentially pushing prices toward $123,150. Support levels remain firm at $119,000, $115,500, and $110,500. A failure to hold these supports could trigger a broader market correction.

The recovery follows a dip from last week's peak of $123,200, with buyers re-entering the market as prices stabilized above $118,000. The hourly chart shows Bitcoin holding strong above the 100-hour simple moving average, reinforcing bullish sentiment.

Bitcoin Nears $120,000 as Whale Inflows Drop—Is the Rally in Trouble?

Bitcoin's rally faces scrutiny as whale activity dwindles and retail participation surges. CryptoQuant data reveals a $2 billion drop in large BTC transfers to exchanges, signaling waning institutional interest. The imbalance raises concerns about the sustainability of the current uptrend.

Despite trading at $120,150—a 1.28% daily gain—technical indicators show cracks in the bullish facade. The RSI above 71 flashes overbought signals while momentum begins fading. Market stability now hinges on whether whales return to counterbalance growing retail inflows.

Binance emerges as the focal point of this divergence, with retail volumes climbing as institutional players retreat. Such disproportionate participation historically precedes volatility, suggesting Bitcoin's foundation may be weaker than price action indicates.

Chainalysis Exposes NCA Officer's Theft of Seized Bitcoin from Silk Road 2.0

Chainalysis has uncovered a significant case of internal corruption involving a UK National Crime Agency officer who misappropriated nearly 50 BTC seized during the Silk Road 2.0 investigation. The stolen Bitcoin, originally confiscated from darknet marketplace administrator Thomas White in 2019, was illicitly transferred and laundered through the Bitcoin Fog mixing service.

Blockchain analytics proved instrumental in tracing the theft despite sophisticated obfuscation attempts. The case demonstrates cryptocurrency's inherent transparency - while digital assets can be stolen, they cannot be hidden. Merseyside Police reopened investigations in 2022 after Chainalysis identified the suspicious transactions.

This incident underscores both the challenges and opportunities in crypto asset recovery. While bad actors continue developing advanced laundering techniques, forensic tools maintain pace. The immutable nature of blockchain creates an unforgiving environment for financial criminals, whether they operate in darknet markets or government agencies.

Why Traditional Investment Rules Are Failing in Crypto Markets

The cryptocurrency market is exposing the limitations of traditional investment strategies as institutional capital floods into digital assets. Modern Portfolio Theory—the cornerstone of institutional investing—is cracking under Bitcoin's volatility, which operates outside conventional risk-return frameworks. Diversification tactics that work for stocks and bonds falter when applied to crypto's nonlinear price action.

Retail investors clinging to dollar-cost averaging face asymmetric risks against algorithmic traders and hedge funds deploying quantitative strategies. The 60/40 portfolio allocation model looks increasingly archaic as correlations between crypto and traditional assets break down. Market structure differences demand new frameworks for risk management in digital asset portfolios.

Can Bitcoin Reach $250K in 2025? Latest Data Points to Explosive Growth

Bitcoin continues to command market attention after hitting a record $123,091.61 on July 14, now trading just 3.25% below that peak at $119,091.35. The minor retracement hasn't dented bullish sentiment, with technical indicators suggesting further upside potential.

The weekly chart reveals strong support at $115K, a level that previously marked consolidation boundaries. Current trading ranges between $122,056 and $115,701 are drawing intense trader interest. Exponential moving averages paint a particularly optimistic picture - with price action holding comfortably above all key EMAs, including the 20-week ($102,555) and 200-week ($58,432) benchmarks.

Market structure appears primed for continuation. The recent breakout candle showed minimal rejection, signaling sustained buyer dominance. Immediate resistance sits at $122K, but a decisive breach could open the path toward $130K. Such momentum would lend credence to projections of Bitcoin reaching $250K by 2025.

Riot Platforms Schedules Q2 2025 Earnings Call Amid Bitcoin Mining Expansion

Riot Platforms, Inc. (NASDAQ: RIOT), a leader in Bitcoin mining, has set its Q2 2025 earnings call for July 31, 2025. The conference will detail financial results for the quarter ending June 30, with an audio webcast available for participants. A replay will be offered post-event.

The company operates across Texas, Kentucky, and Colorado, focusing on vertically integrated Bitcoin mining and high-performance computing. Its ambition is to dominate as the premier Bitcoin-driven infrastructure platform globally.

MicroStrategy's Bitcoin-First Strategy Yields 3,558% Surge, Outpacing BTC's 905% Growth

MicroStrategy's stock (MSTR) has skyrocketed 3,558% over the past five years, dwarfing Bitcoin's 905% appreciation during the same period. The company's aggressive BTC accumulation strategy, spearheaded by executive chairman Michael Saylor, has amassed 601,550 BTC worth over $73 billion—the largest corporate holding globally.

Market capitalization now stands at $116.7 billion as institutional investors reward the uncompromising Bitcoin-centric approach. Comparative analysis reveals traditional assets lagging dramatically: Nasdaq 100 gained 106%, S&P 500 rose 86%, while bonds declined 19%.

Saylor's recent social media revelation—"the ultimate Bitcoin secret"—showcases how leveraged exposure to BTC through equity can multiply returns. The performance validates his thesis that corporate balance sheets benefit from dollar depreciation hedging through cryptocurrency reserves.

Volcon Shares Surge 135% After Announcing $500M Bitcoin Treasury Plan

Electric vehicle manufacturer Volcon saw its stock price skyrocket by nearly 135% following its announcement of a $500 million private placement to establish a Bitcoin treasury. The company plans to allocate 95% of the raised capital—approximately $475 million—toward BTC acquisitions, positioning itself among corporations leveraging cryptocurrency as a hedge against monetary debasement.

The move comes as Volcon reported a $45 million net loss in 2024, with shares declining over 35% year-to-date. "Holding bitcoin on our balance sheet represents a strategic move to safeguard shareholder value and align with a digital future," stated Co-CEO John Kim. The private placement involves selling 50.1 million shares at $10 per share.

Volcon joins a growing cohort of public companies adopting Bitcoin treasuries, mirroring strategies pioneered by firms like MicroStrategy. This institutional embrace continues despite BTC's price volatility, reflecting broader confidence in cryptocurrency as a corporate reserve asset.

French Lawmakers Propose Bitcoin Mining to Address Nuclear Energy Surplus

France's nuclear energy dominance has created an unexpected financial burden. With over 70% of electricity coming from nuclear sources, the country frequently produces more power than it can consume or store. In 2024, this led to €80 million in losses as producers sold surplus electricity at negative prices—sometimes paying €12,000 per megawatt-hour to offload excess capacity.

The National Rally party has introduced a radical solution: repurposing wasted energy for Bitcoin mining. A proposed five-year pilot program would allow energy producers to divert nuclear surplus to cryptocurrency operations. This move could transform an economic liability into a strategic asset while maintaining France's low-carbon energy profile.

Bitcoin Standard to Go Public on Nasdaq via SPAC Merger with Cantor

Bitcoin Standard Treasury Company is set to become a publicly traded entity on Nasdaq under the ticker BSTR following a merger with Cantor Equity Partners I. The deal, structured as a SPAC transaction, includes a substantial Bitcoin treasury and significant fiat financing.

The combined entity will launch with 30,021 BTC and up to $1.5 billion in PIPE financing. Cantor's trust will contribute approximately $200 million, subject to redemptions. The financing structure comprises $400 million in common equity, $750 million in convertible senior notes, and $350 million in convertible preferred stock.

Notably, 5,021 BTC of the treasury comes from in-kind PIPE funding provided by long-time Bitcoin investors. Founding shareholders advised by Blockstream Capital Partners will add 25,000 BTC to the treasury. This positions BSTR as the fourth-largest corporate Bitcoin holder among publicly reported treasuries.

Adam Back, inventor of Hashcash, will serve as CEO, with Sean Bill assuming the role of chief investment officer. The move signals growing institutional confidence in Bitcoin as a treasury asset.

Gemini Predicts Bitcoin Supercycle: Is $250K BTC Realistic?

Google's AI chatbot Gemini has projected a bullish $250,000 price target for Bitcoin by 2025, citing the recent halving event and institutional ETF inflows as key catalysts. Historical patterns suggest post-halving rallies typically unfold over 12-18 months—a trajectory the current cycle appears to mirror.

Spot Bitcoin ETFs now hold a record $148 billion in assets under management, signaling accelerating institutional adoption. The analysis highlights Bitcoin Hyper, a low-cap presale token, as a potential breakout candidate amid growing market optimism.

Is BTC a good investment?

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +6.47% above | Bullish trend confirmed |

| MACD Histogram | -1,347.58 (rising) | Bearish momentum fading |

| Bollinger Position | Upper band test | Overbought but strong |

With 12/26 MACD lines converging (-5,699 vs -4,351) and 3x more bullish news catalysts than bearish (10:2 ratio), BTC presents asymmetric upside potential. Olivia advises: "DCA with 10-15% portfolio allocation, targeting $132K near-term."

Technical indicators show BTC trading 6.47% above its 20-day MA with fading bearish momentum, while positive news flow (10:2 ratio) supports growth. BTCC's Olivia recommends dollar-cost averaging with 10-15% portfolio exposure.